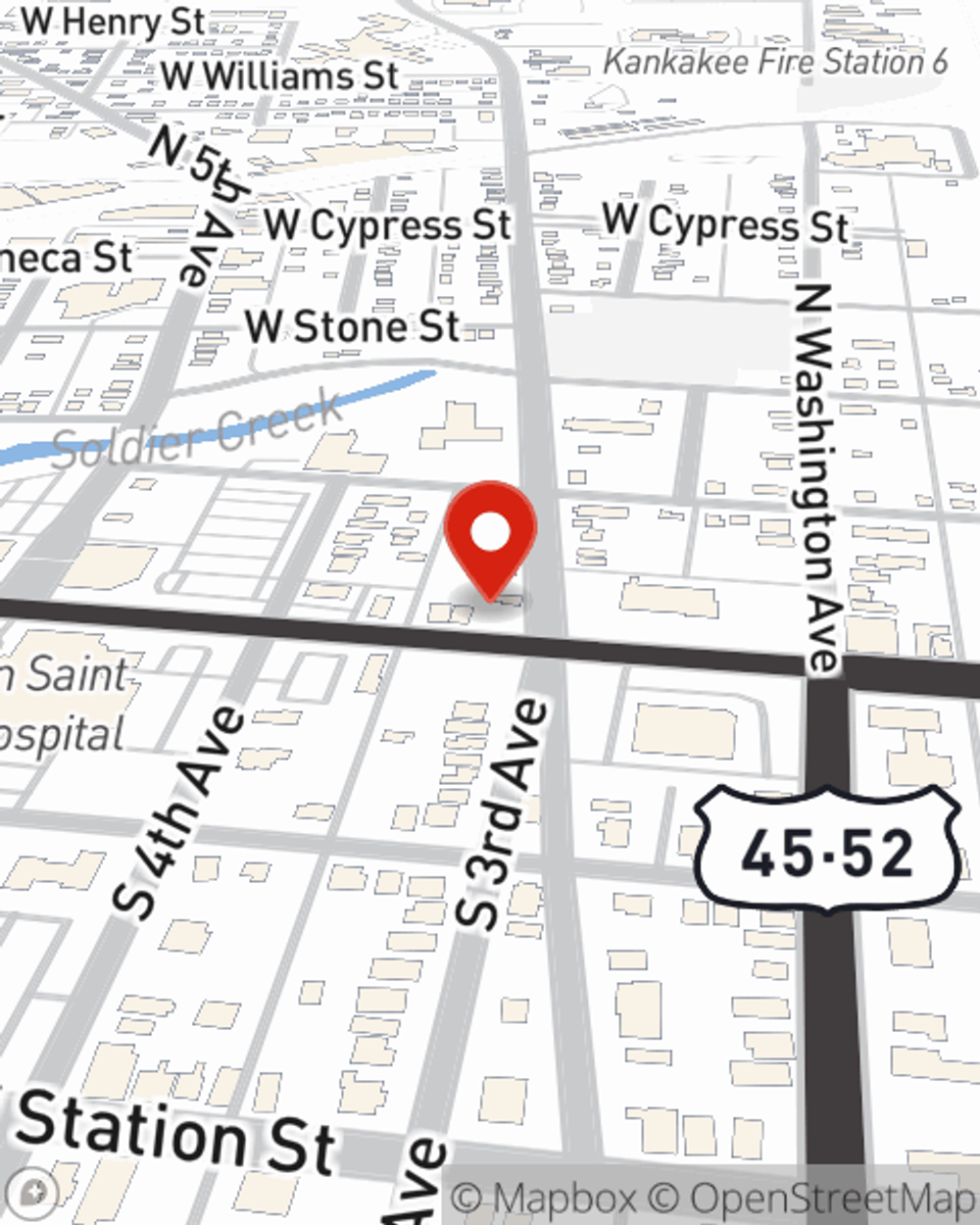

Business Insurance in and around Kankakee

Get your Kankakee business covered, right here!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like business continuity plans, extra liability coverage and a surety or fidelity bond, you can feel secure knowing that your small business is properly protected.

Get your Kankakee business covered, right here!

Cover all the bases for your small business

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a lawn care service, a photography business, or a sign painting company, having the right insurance for you is important. As a business owner, as well, State Farm agent Vince Clark understands and is happy to help with customizing your policy options to fit the needs of you and your business.

Call or email agent Vince Clark to talk through your small business coverage options today.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Vince Clark

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.